2016 was a record-breaking year for new car registrations, driven by leap in leasing

Despite political and economic uncertainty, 2016 was yet another record year for the new car market.

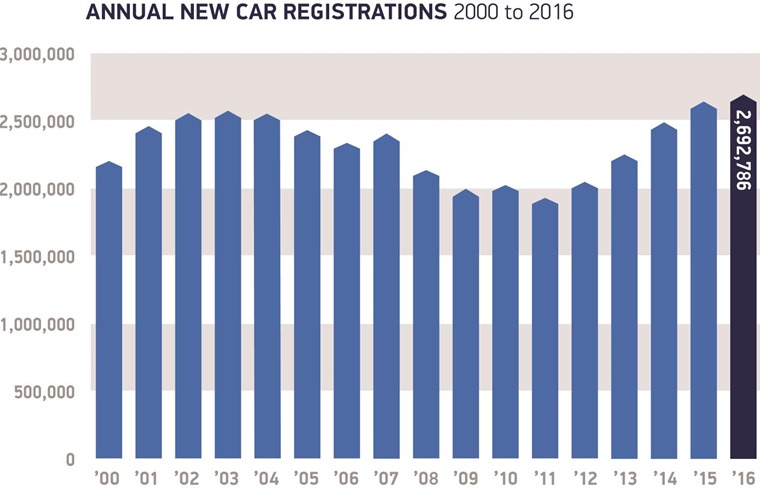

Annual registrations climbed for the fifth year in a row to almost 2.7 million, beating last year’s all-time record high by 2.3%, with experts attributing a lot of the demand increase to the continued growth of Personal Contract Hire (PCH).

The UK new car market experienced year-on-year growth in 10 out of the 12 months on 2016 and is one one of the most diverse and buoyant in the world, with some 44 brands offering nearly 400 different model types.

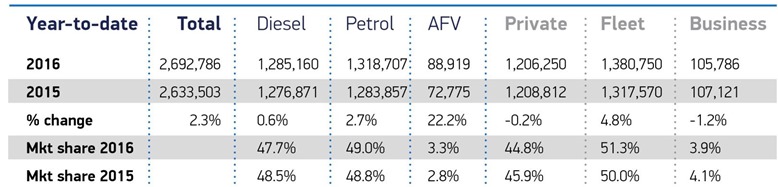

According to SMMT data, private and business car sales both decreased in 2016, so the year’s impressive figures are largely thanks to almost 1.4 million fleet registrations – a 4.8% increase over 2015.

Explaining the statistics, British Vehicle Rental and Leasing Association chief executive Gerry Keaney said rental and leasing companies buy many of these vehicles, so while they will be classed as fleet registrations they are subsequently “leased to consumers”.

LexAutolease takes a similar view: “A significant year-on-year rise in PCH was a key factor to the SMMT figures, with drivers seeking to keep up with the latest models and benefit from new technology and safety features.”

Full steam ahead for PCH

Talking on BBC Radio 4’s Today programme about the SMMT’s stats, personal finance expert Merryn Somerset Webb also suggested the strong new car performance in 2016 was due to demand for attractive personal contract finance packages.

Webb also noted that the majority of people who use PCP finance do not actually pay the balloon payment on their PCP deals. She said: “You can pay the balloon payment, but most people don’t, they return the car … This is why we have one of the newest fleets of cars in the western world.”

Any common trends?

Aside from PCH uptake, Alternatively Fuelled Vehicles (AFVs) saw large growth too. No surprise really, considering everything points towards a hybrid and all-electric future. With 88,919 finding customers this year, AFV registrations saw a marked 22.2% growth, compared to to 2015’s 72,775.

As for the traditional battle between diesel and petrol, the latter made up the largest number of registrations, making up 49% of the market overall. Diesel registrations still grew overall though, taking a 47.7% slice of the market. That’s in spite of recent negative publicity, a renewed interest in AFVs, and of course the wake of Dieselgate.

What about 2017?

Despite the record-breaking year, the SMMT predicts that new car registrations will stall this year, with a lull of around 5% expected by the end of 2017. However, Mike Hawes, SMMT chief executive said that despite post-Brexit worries, the drop was not directly due to the UK’s decision to leave the EU.

Here’s our top automotive predictions for the year ahead

He commented: “"We're talking about a market that is at peak demand, following the sector's resurgence after the recession. Growth at the rate we have seen can't continue forever. This is historically an incredibly high level. We're not talking about a collapse."

Is a weaker pound a worry?

An area that may cause concern for the industry is the impact of the weaker sterling since the Brexit vote. With the UK importing 85% of its new vehicles, Hawes predicts we will see list prices for new cars rise. He said:“Ultimately, a fall in sterling is going to flow through to an increase in pricing, probably of the magnitude of 2-3% over the coming months.”

How will Brexit affect the car industry?

Hawes was quick to point out that this shouldn’t affect consumer spending hugely however, due to the fact most new cars registered involve some kind of finance such as PCH, HP or PCP. A 2-3% increase over the next 12 months should only equate to a tiny rise in monthly payments.

2016’s most popular models

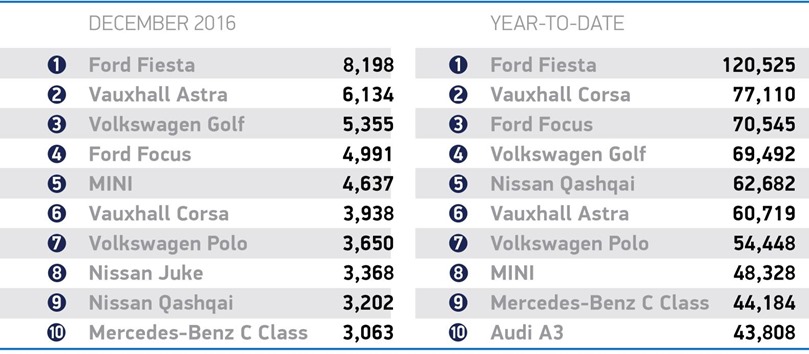

The final month of the year saw slowdown in demand, although this is not unusual given the time of year. December marked a –1.1% slump in registrations, with 178,022 registrations before the year’s end.

Despite 2017’s forecast for slower growth, it’s likely we’ll still see a surge in registrations before a hike in VED road tax prices from 31 March. Anyway, without further ado, here’s the most popular cars for the closing month of the year, along with the 2016’s most popular cars overall…

See how the UK’s top ten most popular cars reflect the most popular leases