Have lease prices really increased by 8% in two months? Our data shows it’s more like 1%…

Recent research by accountancy firm UHY Hacker Young has claimed that monthly payments for leasing deals have risen by 8% in just two months, but ContractHireAndLeasing’s data finds things aren’t that dramatic, with a nominal 1.1% rise in monthly prices over the same period.

Has the post-Brexit rise in car prices started? The answer is actually, not really.

Picking from a “basket” of deals from one broker, UHY Hacker Young concluded that between October and December, average monthly payments rose from £245.70 to £264.70.

Keen to see how our data compared, we investigated all deals on our site from brokers and franchised dealers from October to December to see if the rise was as dramatic as these figures suggest. Rather than a £19 hike in average lease prices, we’ve found that they’re actually up by less than £3. Here’s how things panned out…

*Price rises (UHY Hacker Young) – 8% increase

|

| Brand | Model | Spec | Oct price | Nov price | Dec Price |

| 1 | Ford | Fiesta | 1.0 Titanium 3dr | £169.74 | £169.74 | £169.74 |

| 2 | Vauxhall | Corsa | 1.4 Design 5dr | £167.74 | £167.34 | £167.34 |

| 3 | Ford | Focus | 1.5 TDCi 120 Titanium | £230.94 | £240.54 | £240.54 |

| 4 | Volkswagen | Golf | 1.6 TDI 110 Match Edition 5dr | £226.764 | £241.164 | £241.164 |

| 5 | Nissan | Qashqai | 1.2 DiG-T N-Connecta | £259.536 | £259.536 | £259.536 |

| 6 | Vauxhall | Astra | 1.6T 16V 200 Sri | £242.34 | £242.34 | £250.74 |

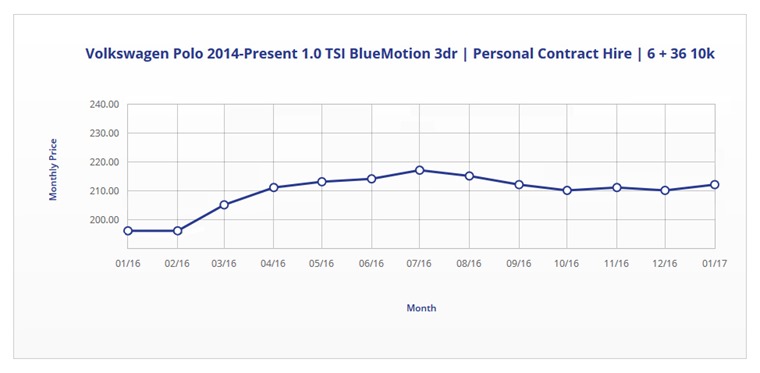

| 7 | Volkswagen | Polo | 1.0 TSI BlueMotion 3dr | £216.336 | £218.736 | £218.736 |

| 8 | Mini | Hatchback | 1.5 Cooper D Auto (Chilli Pack) 5dr | £232.14 | £279.54 | £297.54 |

| 9 | Mercedes-Benz | C-Class | C220d Sport 4dr | £382.74 | £382.74 | £399.54 |

| 10 | Audi | A3 | 2.0 tdi Sport S Tronic 3dr | £329.136 | £307.536 | £307.53 |

|

|

|

| Average | £245.70 | £250.50 | £264.70 |

* Monthly cost on personal contract hire, including VAT source: Nationwide Vehicle Contracts. The analysis has been performed by comparing a basket of vehicles for a monthly PCH deal.

**Price rises (ContractHireAndLeasing) – 1.1% increase

|

| Brand | Model | Spec | Oct price | Nov price | Dec Price |

| 1 | Ford | Fiesta | 1.0 Titanium 3dr | £164 | £168 | £168 |

| 2 | Vauxhall | Corsa | 1.4 Design 5dr | £177 | £178 | £178 |

| 3 | Ford | Focus | 1.5 TDCi 120 Titanium | £228 | £228 | £228 |

| 4 | Volkswagen | Golf | 1.6 TDI 110 Match Edition 5dr | £203 | £198 | £200 |

| 5 | Nissan | Qashqai | 1.2 DiG-T N-Connecta | £236 | £226 | £242 |

| 6 | Vauxhall | Astra | 1.6T 16V 200 Sri | £215 | £214 | £214 |

| 7 | Volkswagen | Polo | 1.0 TSI BlueMotion 3dr | £210 | £211 | £210 |

| 8 | Mini | Hatchback | 1.5 Cooper D Auto (Chilli Pack) 5dr | £233 | £274 | £253 |

| 9 | Mercedes-Benz | C-Class | C220d Sport 4dr | £353 | £346 | £355 |

| 10 | Audi | A3 | 2.0 tdi Sport S Tronic 3dr | £305 | £302 | £302 |

|

|

|

| Average | £232.40 | £234.50 | £235 |

** ContractHireAndLeasing all average prices based on 6+35 10k p/a deals. Prices correct at time of writing.

What does it mean?

UHY Hacker Young’s research shows that average prices remained relatively steady October through December. However, it showed that some models experienced large fluctuations in prices. The biggest hike came on the Mini 1.5 Cooper D 5dr, which increased from £233 to £274 between October and November, before settling at £253 in December.

In contrast, according to our comprehensive data, the average price for the same cars only rose from £232.50 in October to £235 in December, marking a 1.1% increase. That’s the kind increase we’d expect to see, if we use October and November’s inflation rates – 0.9% and 1.2% respectively – as a base.

So which one is the best insight? We’re not sure on the exact variables and lease profiles UHY Hacker Young used for its study, and how many deals, but our findings are based on a 6+35 personal lease deal with a yearly allowance of 10,000 miles. In other words, a typical lease profile.

Our average prices were also calculated from over 4,000 leasing deals from hundreds of advertisers – offering a clear picture of the entire leasing market.

Don’t believe the hype, it isn’t all doom and gloom…

Yes, it is likely that the new car market will slow down in 2017 after two years of record-breaking growth.

Meanwhile, a fall in the value of sterling is likely to place pressure on vehicle manufacturers and their distribution channels to pass costs onto consumers, as UHY Hacker Young has suggested, but we did not see any costs being notably shifted onto consumers during October to December.